Wednesday, February 15, 2006

Wake of the Flood

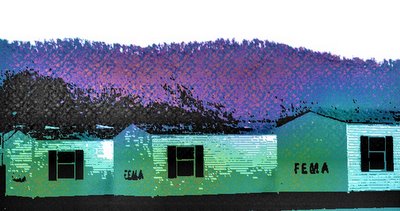

I saw Juliepatchouli has a photo (which I copied and Jedited) of FEMA housing sitting on a lot in Granger County being of no use to anyone. I started thinking...the way a stressed out Prophet of the Obvious will sometimes:

What are they going to do with these?

Can I have one?

How do I appily?

Can I claim a hardship since Katrina caused me to blow my already hyper-stressed-bankrupt-forclosed-repossed budget for many weeks by paying more for fuel, food and everything else with no pay-raise?

Katrina did not cause a direct flood in my home, but it sure as heck helped to sink it. I am just sitting here not trying to make matters worse by going to work everyday wishing for good things, paying 9.5% sales tax on everything, fuel taxes, income tax, property tax and too much for health insurance.

:: posted by Tennessee Jed, 8:23 PM

4 Comments:

I bet if the government wasn't so Fu*ked up those trailers would be available to the folks that needed them instead of just sitting on some lot doing no one any good. 9.5% sales tax...that's Fu*king nuts too.

Good post.

Good post.

Yea, we do not have a State income tax here so there is a sales tax on all items even milk and bread 9.5% across the board. I would guess it is the highest sales tax in the nation. I am starting to think an income tax would be better because at least one could haggle over deductions. I suspect that if we pass a state income tax then the sales tax would drop a wee bit only to increase in a year or two to the same level as now.

Hell, we don't have a state income tax and our sales tax is 7% (food is exempt). Of course we do have the idiot's brother for a governor so I guess that's paying our dues some how.

An income tax would definately be better than a sales tax. By definition, an income tax is progressive meaning the more you make the more you pay (unless it's implemented in screwball, Republican fashion and it's a flat tax); whereas, a sales tax is regressive meaning everyone pays the same amount of tax regardless of income. I had no idea that Tennessee was like this.

But I bet if we dug behind the scenes: the coal, timber, and natural gas industries probably get all kinds of lucrative tax breaks and "incentives" aka corporate welfare that if taken away could help a lot of your state's woes. That wouldn't surprise me because it seems situation in most Appalachian states- most notably West Virginia and up here we have an income tax and a 6% sales tax and a 5% food tax.

It just, well, it just downright pisses me off about they way they do us.

But I bet if we dug behind the scenes: the coal, timber, and natural gas industries probably get all kinds of lucrative tax breaks and "incentives" aka corporate welfare that if taken away could help a lot of your state's woes. That wouldn't surprise me because it seems situation in most Appalachian states- most notably West Virginia and up here we have an income tax and a 6% sales tax and a 5% food tax.

It just, well, it just downright pisses me off about they way they do us.